Decoding the Platinum Group Metals (PGMs) Market: Trends and Insights

In the ever-evolving landscape of commodities, platinum group metals (PGMs) emerge as a category of unique significance. Comprising six closely related metals—platinum, palladium, rhodium, ruthenium, iridium, and osmium—PGMs play pivotal roles across various industries, from automotive catalytic converters to cutting-edge electronics. As we navigate the complexities of today’s market, let’s delve deeper into the current trends shaping the prices of these precious metals.

The Automotive Catalyst Connection:

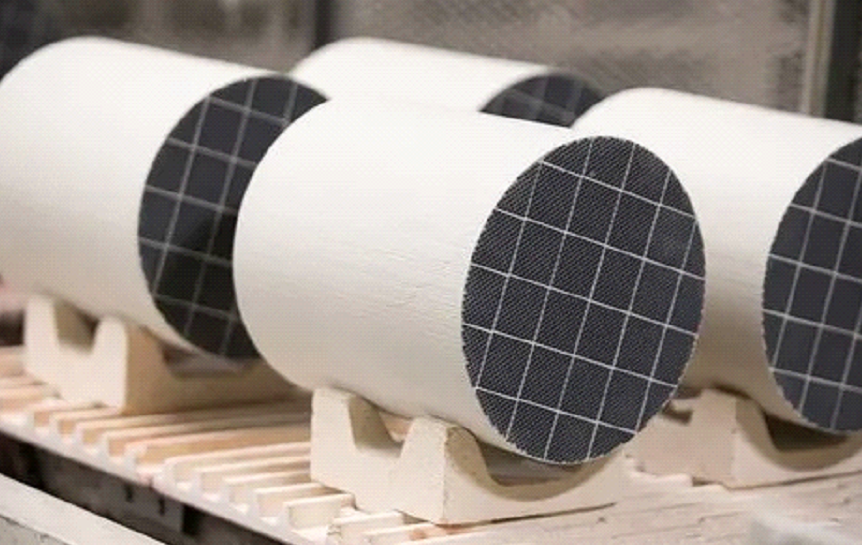

- The automotive industry, particularly the demand for catalytic converters, drives the PGM market. Platinum, palladium, and rhodium serve as essential components in catalytic converters, effectively reducing harmful emissions from vehicles.

- With global climate initiatives gaining momentum, the quest for cleaner, greener automotive technologies has surged, directly impacting PGM prices. Stricter emission standards drive the dynamic PGM market.

Palladium’s Price Surge:

- Palladium, a key player among PGMs, has witnessed remarkable price volatility in recent years.

- Stricter emission regulations and the rising popularity of gasoline-powered vehicles have fueled demand for palladium, resulting in a supply-demand imbalance.

- Record-high palladium prices present both opportunities and challenges for market participants, closely monitored by investors and industry observers.

Rhodium’s Astonishing Rally:

- While palladium grabs headlines, rhodium—a crucial PGM—quietly experiences an astonishing rally.

- Rhodium’s unique properties make it highly effective in reducing nitrogen oxide emissions in diesel engine catalytic converters.

- Limited global supply and rising demand have propelled rhodium prices to unprecedented levels, providing valuable insights for PGM stakeholders.

Global Economic Factors:

- Beyond the automotive sector, broader economic dynamics significantly influence PGM prices.

- Geopolitical events, economic policies, and trade dynamics interconnect global markets, impacting PGM supply and demand.

- Monitoring macroeconomic factors becomes crucial for anticipating shifts in PGM prices as the world economy recovers from various challenges.

The Role of Recycling:

- PGMs’ strategic importance underscores the critical role of recycling in the supply chain.

- Specialized companies focus on recovering PGMs from spent catalytic converters and electronic scraps, contributing to sustainability efforts.

- Examining the recycling landscape sheds light on the circular economy’s impact on PGM availability and pricing.

Conclusion:

- Navigating the PGM market demands a comprehensive understanding of intricate factors.

- From cleaner automotive technologies to the remarkable rallies of metals like palladium and rhodium, staying informed is vital for investors, professionals, and enthusiasts.

- Innovation, regulation, and global dynamics will continue shaping the future of these precious metals.